Index Funds

- Eliav Amouyal

- Jun 11, 2024

- 4 min read

Updated: Jun 26, 2025

Introduction: Understanding Index Funds

Index funds have gained immense popularity among investors for their simplicity, low costs, and consistent performance. These investment vehicles are designed to replicate the performance of a specific market index, making them an excellent choice for both novice and experienced investors. In this guide, we will explore what index funds are, how they work, their benefits, and why they might be an ideal addition to your investment portfolio.

What Are Index Funds?

Definition and Purpose An index fund is a type of mutual fund or exchange-traded fund (ETF) designed to match or track the components of a financial market index, such as the S&P 500 or the Dow Jones Industrial Average. The primary goal of an index fund is to provide broad market exposure, low operating expenses, and low portfolio turnover.

How Index Funds Work Index funds are passively managed, meaning that fund managers do not make active investment decisions. Instead, they aim to replicate the performance of the chosen index by holding all or a representative sample of the securities in that index. For example, an S&P 500 index fund will invest in the 500 companies that comprise the S&P 500 index.

Advantages of Index Funds

Diversification Index funds provide instant diversification, as they invest in a wide range of securities within a specific index. This reduces the risk of significant losses because the performance is spread across many companies or assets.

Low Costs One of the most attractive features of index funds is their low cost. Since they are passively managed, index funds have lower management fees and expenses compared to actively managed funds. These cost savings can significantly enhance overall returns over time.

Consistent Performance Index funds aim to mirror the performance of their benchmark index. While they won't outperform the market, they also won't underperform it significantly, providing investors with stable and predictable returns.

Simplicity Investing in index funds is straightforward. Investors do not need to worry about picking individual stocks or timing the market, making index funds an excellent option for those who prefer a hands-off approach to investing.

Types of Index Funds:

Stock Index Funds These funds track stock market indexes such as the S&P 500, NASDAQ-100, or the Russell 2000. They provide exposure to a broad range of companies and industries.

Bond Index Funds Bond index funds track indexes like the Bloomberg Barclays U.S. Aggregate Bond Index. They offer exposure to various types of bonds, including government, corporate, and municipal bonds.

International Index Funds These funds track indexes that include international stocks, such as the MSCI EAFE Index, providing exposure to global markets outside of the United States.

Sector and Industry Index Funds Sector index funds focus on specific sectors of the economy, such as technology, healthcare, or energy. They allow investors to target particular industries while maintaining the benefits of index investing.

How to Invest in Index Funds

Choosing the Right Index Fund When selecting an index fund, consider the following factors:

Expense Ratio: Lower expense ratios mean lower costs and higher net returns.

Tracking Error: This measures how closely the fund follows its benchmark index. Lower tracking error indicates better performance.

Fund Size: Larger funds generally have lower expense ratios and better liquidity.

Where to Buy Index Funds Index funds can be purchased through various platforms:

Brokerage Accounts: Many online brokerages offer a wide range of index funds and ETFs.

Robo-Advisors: These automated investment platforms often include index funds in their portfolios.

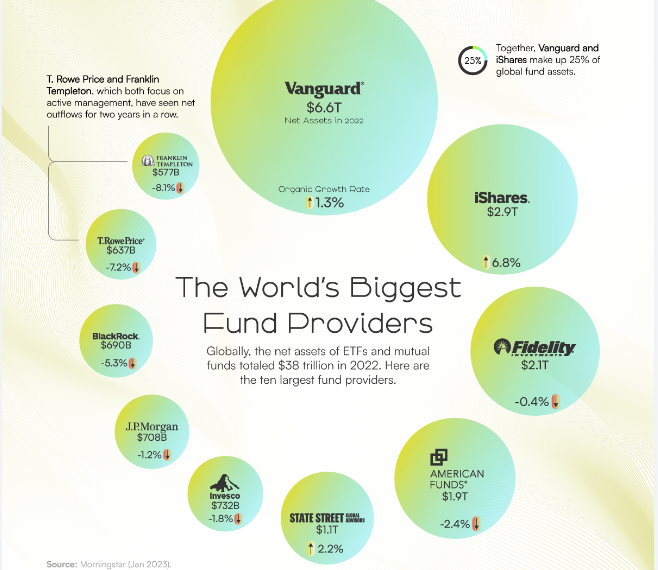

Directly from Fund Providers: Companies like Vanguard, Fidelity, and Schwab offer index funds directly to investors.

Real-World Examples

The Success of Vanguard Vanguard is one of the largest and most well-known providers of index funds. Founded by John Bogle, Vanguard introduced the first index mutual fund for individual investors in 1976. Vanguard's philosophy of low-cost, diversified investing has made it a favorite among investors.

SPDR S&P 500 ETF (SPY) The SPDR S&P 500 ETF is one of the most widely traded ETFs in the world. It aims to replicate the performance of the S&P 500 index and provides investors with exposure to the 500 largest companies in the United States.

Risks and Considerations

Market Risk While index funds are diversified, they are still subject to market risk. If the overall market declines, the value of the index fund will also decrease.

Lack of Flexibility Index funds do not allow for active management or the ability to capitalize on short-term market opportunities. They simply follow the index, regardless of market conditions.

Potential for Lower Returns Since index funds aim to match the market, they will not outperform it. Investors seeking higher returns may prefer actively managed funds, despite the higher risks and costs.

Conclusion:

Index funds offer a simple, cost-effective way to invest in the stock and bond markets. Their broad diversification, low costs, and consistent performance make them an attractive option for both new and seasoned investors. By understanding how index funds work and considering their benefits and risks, you can make informed decisions that align with your investment goals.

Comments