Investing in dividends to generate passive income

- Eliav Amouyal

- Jun 22, 2023

- 4 min read

Updated: Jun 26, 2025

Introduction:

The concept of passive income has attracted an increasing amount of attention in recent years. Passive income is defined as earnings obtained with minimal effort or direct involvement. People who achieve passive income receive money regularly and consistently without needing to do much. Many people seeking financial independence and stability find it to be an appealing financial objective. Investors who achieve dividends from their stocks are able to sit and wait for the dividends to reach their bank accounts.

Dividend investing has emerged as a popular and effective method of earning passive income among the various strategies available. The dividend yield of a stock can be calculated by dividing the annual dividends paid per share by the current share price.

For example, Microsoft pays out £0.53 dividends per share every quarter, and there are four quarters per year. Microsoft’s current share price is £262. 0.53 multiplied by 4 is 2.12, and that is divided by 262, leaving a dividend yield of £0.82 per share per year. This is a relatively low amount, the average dividend yield in the S&P 500 is 1.66%.

Pioneer Natural Resources Company has an 11.41% dividend yield. This is much larger than that of Microsoft however the risk is that it is much more volatile, and therefore riskier. Safer stocks with high dividend yields include Coca-Cola, UPS, Best Buy, McDonald’s, ExxonMobil, and Chevron.

Understanding Dividend Investing:

Dividend investing entails purchasing shares of dividend-paying stocks or funds. Dividends are recurring financial payments that companies pay to their shareholders, typically once every three months (or once per quarter). The funds are distributed proportionately among shareholders and are generated by the company's profits. By investing in stocks with higher dividend yields, investors are able to create a source of passive income for themselves.

Advantages of Dividend Investing:

Investing in dividends offers an assured and regular income source. Dividends provide a predictable source of income as opposed to the unpredictable nature of capital appreciation. Well-established dividend-paying companies frequently continue to pay dividends throughout downturns in markets, giving investors a sense of financial security.

Dividend reinvestment offers an opportunity to substantially increase the impact of compounding. Investors are able to benefit from the compounding effect by reinvesting dividends back into buying more shares, which would lead to their assets expanding exponentially over time. In addition to expanding the overall number of shares, this reinvestment also raises the total dividend income received in subsequent quarters.

A diversified portfolio of dividend-paying equities can reduce risk and offer a certain level of stability. Dividends can operate as a safety net against market volatility, giving investors a cushion during volatile periods. Additionally, companies that pay dividends frequently belong to many sectors, ensuring industry diversification.

Investing in dividends can be an effective method to generate long-term wealth. Investors can gain from both capital growth and increasing dividend income by reinvesting dividends and letting them compound. This dual benefit has the potential to greatly increase a person's overall assets and financial stability over time.

Considerations for Dividend Investing:

Assessing the sustainability of dividends requires an understanding of the management team, market dynamics, and competitive position of the company. Despite the appealing nature of high dividend rates, it is important to consider the duration that those payouts will continue. Long-term dividend payments may be difficult to maintain for companies with very high dividend yields or inconsistent earnings. It's important to find a balance between the dividend yield and the business's capacity to continue making consistent payouts. The sustainability of a corporation can be determined by looking at its cash flow generation, dividend payout ratio, and dividend history.

It is advisable to create a diverse portfolio of dividend-paying stocks. This diversification distributes the risk among various industries and businesses, minimising the effect of the performance of any one stock on the portfolio as a whole. The risk of sector downturns can be reduced by diversifying across different industries and market capitalizations, resulting in a portfolio that is more stable and resilient.

Strategies for Maximizing Dividend Investing:

Companies that have continuously increased their dividends for a minimum number of years (such as 25 years or more) are known as dividend aristocrats. As these businesses have demonstrated their capacity to adapt to diverse economic environments and reward shareholders, investing in dividend aristocrats can offer a consistent and expanding income source.

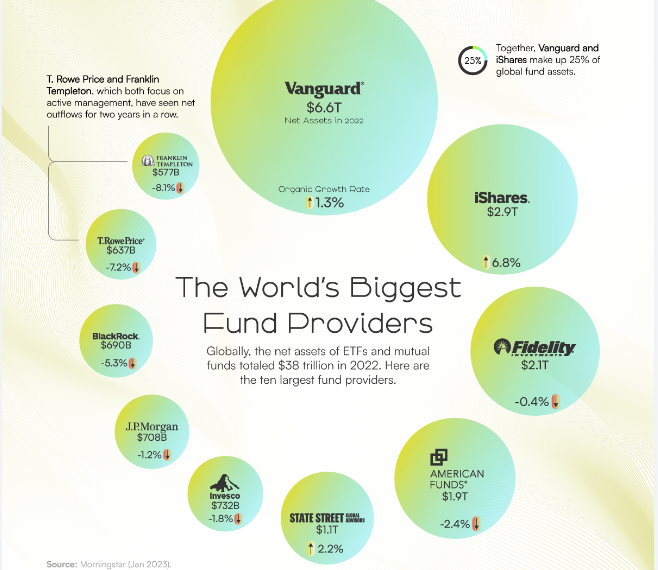

Mutual funds and exchange-traded funds (ETFs) that concentrate on dividend-paying equities offer convenience and portfolio diversification. These funds aggregate money from investors to invest in a portfolio of dividend stocks, providing investors with access to many companies from a variety of different sectors and industries without the need for in-depth stock research.

Investors can automatically reinvest their dividends into the purchase of new shares of a company's stock through the use of Dividend Reinvestment Plans (DRIPs). This would enable them to compound their money, and gain exponential returns for long-term wealth.

Companies with promising dividend futures can be found by conducting in-depth studies and analyses of relevant sectors and industries. There is typically a higher concentration of dividend-paying corporations in some sectors, including utilities, consumer goods, and healthcare. Investors can increase their potential for dividend income by concentrating on industries with favourable traits and growth potential.

Conclusion:

In conclusion, dividend investment has many benefits for investors, including the possibility of consistent income, compound growth and diversification. To maximise the advantages of this strategy, however, it is essential to do in-depth research, assess dividend sustainability, and diversify investments into accounts. Individuals that include dividend investing in their overall investment plan are more likely to develop a reliable passive income stream. Bibliography:

Chen, J. (2022) Dividend reinvestment plans (drips): Compound your earnings, Investopedia. Available at: https://www.investopedia.com/terms/d/dividendreinvestmentplan.asp (Accessed: 22 June 2023).

Fatria, A. (2021) Passive income, salary & profits concept, a man relaxes waiting for..., iStock. Available at: https://www.istockphoto.com/vector/passive-income-salary-profits-concept-a-man-relaxes-waiting-for-the-money-to-enter-gm1296428288-389850570?phrase=passive%2Bincome (Accessed: 22 June 2023).

Koyfin (no date) Pioneer Natural Resources Company (PXD) dividend date & history, Koyfin. Available at: https://www.koyfin.com/company/pxd/dividends/#:~:text=Pioneer%20Natural%20Resources%20Company’s%20(%20PXD,%2413.33%20in%20dividends%20per%20year. (Accessed: 22 June 2023).

Microsoft Share Price & Annual Dividend Payout (no date) Google search. Available at: https://www.google.com/search?q=microsoft%2Bdividend&rlz=1C5CHFA_enGB969GB969&oq=microsoft%2Bdividend&aqs=chrome..69i57j0i512l6j69i60.3940j0j7&sourceid=chrome&ie=UTF-8&safe=active&ssui=on (Accessed: 22 June 2023).

MicroStockHub (2021) White ladders leaning onto White British pound symbols and Red Bull’s..., iStock. Available at: https://www.istockphoto.com/vector/white-ladders-leaning-onto-british-pound-symbols-and-bulls-eye-target-on-blue-wall-gm1344969150-423174434?phrase=dividend (Accessed: 22 June 2023).

S&P 500 dividend yield (I:SP500DYT) (2023) S&P 500 Dividend Yield. Available at: https://ycharts.com/indicators/sp_500_dividend_yield#:~:text=S%26P%20500%20Dividend%20Yield%20is,month%20and%201.37%25%20last%20year. (Accessed: 22 June 2023).

Comments