Compounding

- Eliav Amouyal

- Oct 25, 2022

- 2 min read

Updated: Jan 16, 2023

Compounding is a powerful tool that generates wealth over time. It is important to understand how compounding works and how to use it to your advantage to maximize the potential of your investments.

In the field of investing, compounding is the process of earning interest on both the principal invested and the accumulated interest from previous periods. Take, for example, a £1,000 investment with a 5% annual return. The investment would have grown to £1,050 after one year (£1000 x 1.05), and to £1102.50 after two years (£1050 x 1.05).

As you can see, the compounding effect causes the investment to grow at an exponential rate.

Why should you start investing at a young age?

“The wise man once said invest young.”- Warren Buffett

Example:

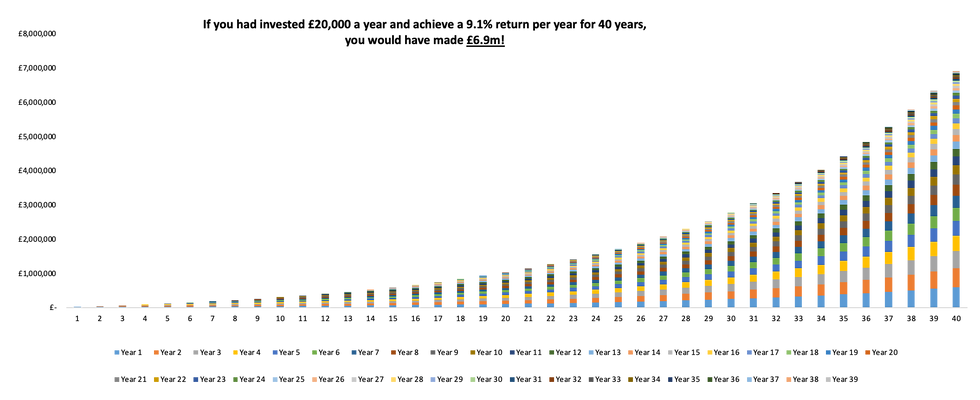

Let's say you are 25 years old and save £20,000 a year to invest in the S&P 500, and you do this each year until the age of 65 (when you may retire). In the past 40 years, the S&P 500 has averaged 9.1% a year on average. Using this information and putting it into a spreadsheet, by the time you retire, you will have made £6,921,301!

As can be seen from the graph, compounding growth is exponential. Whilst investments that don’t compound offer linear returns.

If this data was not compounded, you would only have made £2.2m. When an investment is not compounded, it increases by the same amount each year, regardless of how long the investment is held. This is what makes investing such a powerful tool for long-term investors. Moreover, this is also the reason why £67 billion of Warren Buffett's £70 billion net worth came after his 65th birthday. This is what makes compounding such a powerful tool.

Jim Simons is an investor who achieved an astounding annual return of 66% for 30 years, generating a wealth of £23 billion pounds over that timeframe.

Had he invested for 70 years at the same rate of return, he would have created a wealth of £53,034,453,838,931,927,040!

Warren Buffett started investing at the age of 11 and is still investing at the age of 92. The reason he has amassed so much wealth is that he has been investing for extremely long periods of time. Had he started later, and retired at the age of 65, he would be a millionaire. As put by Morgan Housel in his book 'The Psychology of Money' Buffett's skill was investing, however, his secret was time.

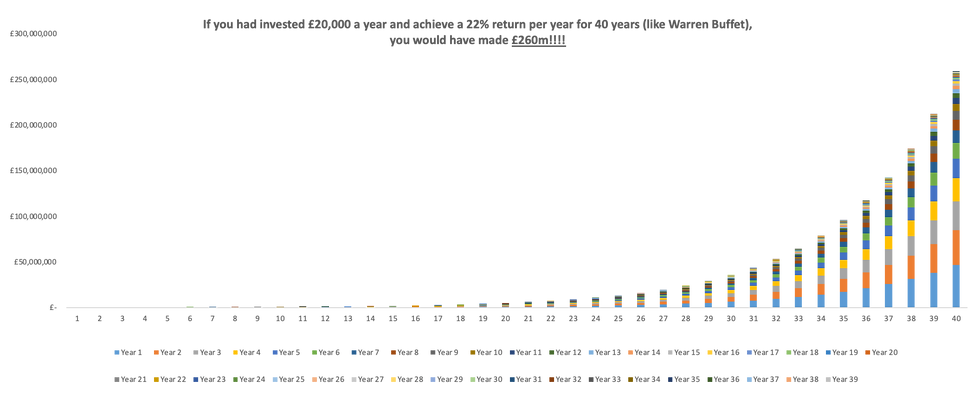

This graph shows how, if you had invested the same amount of money at a 22% annual return per year for 40 years you would have made £260m!

Compound interest, when combined with the power of time can be a powerful tool for growing wealth. The earlier you begin investing, the more time your money has to grow and compound. Several essential variables influence compounding power:

The annual return: A greater annual return indicates that your investment will compound faster.

The duration of investment: The longer the investment, the higher the compounding will be. This is why, long-term investing allows you to take advantage of the power of compounding.

Bibliography

Ashu (2017) Compound interest – a real 8th wonder!, The Investment Mania. Available at: http://www.theinvestmentmania.com/compound-interest-real-8th-wonder/ (Accessed: January 16, 2023).

What is compounding? an explanation of compound interest (2022) Stash Learn. Available at: https://www.stash.com/learn/what-is-compounding/ (Accessed: January 16, 2023).

First website i've found on this topic that actually tells me what i want to know. Thank you very much