Should you invest in the S&P 500?

- Eliav Amouyal

- Dec 19, 2022

- 2 min read

Updated: Jan 16, 2023

“If you've got a 10-year time horizon, hold the S&P 500 and watch and wait.“ - Warren Buffett

The S&P 500, also known as the Standard & Poor's 500, is a market index that monitors the results of the 500 highest market capitalization companies listed on the NYSE and NASDAQ such as Apple, Google, Microsoft, Amazon, Tesla and many others.

These businesses come from a variety of industry sectors, including finance, healthcare, consumer goods, and technology. The S&P 500 is widely regarded as a key indicator of the general performance of the US stock market.

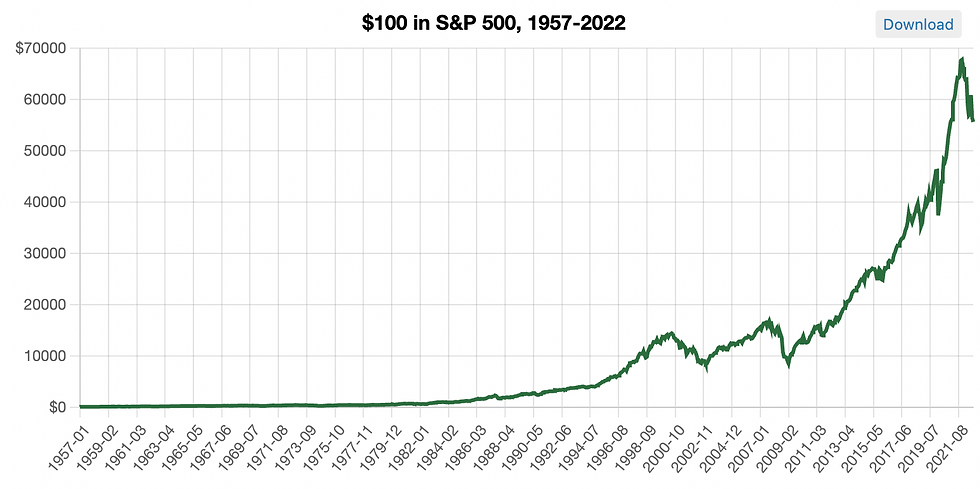

This graph shows how much $100 invested into the S&P 500 becomes over 65 years. The true increase comes after a long period, which is why the S&P 500 can be a great investment in the long term.

Investing in stocks is a popular strategy for achieving long-term financial success. Those investing in stocks aim to make money by buying a stock at a low price and selling once it's reached a higher price. Investing allows you to buy a piece of a company and receive regular dividend payments, or receive capital gains as the value of your shares increases. It is important to know the different types of stocks, such as value stocks, growth stocks, and income stocks, so that you can best match investments to your goals for the future.

Notwithstanding, it's crucial to remember that investing in the S&P 500, like any other investment, involves some risk. The stock market can be volatile, and the value of what you've invested can fluctuate substantially over time. Furthermore, the result of the S&P 500 can be influenced by a variety of factors, such as economic changes, political events, and natural disasters.

To evaluate whether the decision to invest in the S&P 500 is appropriate for you, consider your investment objectives and risk tolerance. The S&P 500 may be a good choice if you have a long investment horizon and are comfortable with the possibility of short-term volatility in the value of your investment. If you have a short-term investment perspective or are not willing to experiment with the risk of financial loss, you should look into other alternative investments.

Overall, investing in the S&P 500 is a great decision. Not only is it made up of 500 large U.S. companies, which makes it easier to diversify your portfolio, but it has historically experienced positive gains over time. Additionally, the companies that make up the index are generally successful, which means investing in the S&P 500 can provide you with the potential for long-term, reliable returns.

Bibliography

Pan, J. (2022) Warren Buffett recommends low-cost index funds for most folks - but Bofa says the S&P 500 is the 'worst thing to hold' right now. buy these 4 top sectors to avoid confusion, Yahoo! Yahoo! Available at: https://uk.movies.yahoo.com/warren-buffett-recommends-low-cost-120000170.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAAVHcTPWRYdUwW2pJcmbH27LZSejGG3Q1MueCmd8MV5_ZEo4rHIJ7CQPHpkoBv0BBBLaZu1_rmf07wwOIG4wNKMz_92Erg0SbbVeaxyt8NTXkggGRFijJnardIrLfE9ak9bkriamP4lD8tE_1Q30d2ZTA0QAGj0mOkVk3F5zoA2d (Accessed: January 16, 2023).

Wang, L. (2022) Wall street capitulation calls get ever harder as stocks bounce, Bloomberg.com. Bloomberg. Available at: https://www.bloomberg.com/news/articles/2022-10-03/wall-street-capitulation-calls-get-ever-harder-as-stocks-bounce?leadSource=uverify+wall (Accessed: January 16, 2023).

Kenton, W. (2022) S&P 500 index: What it's for and why it's important in investing, Investopedia. Investopedia. Available at: https://www.investopedia.com/terms/s/sp500.asp (Accessed: January 16, 2023).

Comments